Here is the list of metals we accept and average metal scrap prices per pound. In order to estimate your scrap value, please fill the scrap pick up form or just call us. Dr Copper’s most important diagnosis may yet lie ahead.Greener Recycling has been purchasing metal scrap for cash or any form of payment you prefer since 2009. As the cycle unfolds, copper prices will signify just how smoothly supply is responding to demand. Habits of capital discipline formed in the previous, slow-growth business cycle are not obviously well suited to an economy running hot. If this time proves to be different, it will be because of a peculiar clash. Supply shocks have generally washed out of inflation quickly. Copper’s rebound began in the second quarter with a. By March, copper prices had sunk to their lowest point at 4617.50. In 2020, copper prices started the year trending above 6000, but as the coronavirus pandemic hit worldwide, lockdowns and other measures were taken hitting supply and demand. The view of central bankers is that today’s supply shortages are likely to be temporary and inflation will prove transient. The Coronavirus Pandemic and Copper Prices. It will take further rallies in copper prices to chip away at this mindset.

“Capital discipline” is an industry slogan. And mining firms, burned by the commodities bust of the early 2010s, have focused more on paying out dividends than on investing in new supply. It takes two to three years to expand output at an existing copper mine and a decade or more to develop a new one. In the oil market, shale production can ramp up if prices warrant it.īut copper supply is far less flexible. The response in agricultural products is simply to grow more crops. And high commodity prices are often their own nemesis. Without a boom in China, there cannot be a supercycle. Policymakers in China, the world’s largest consumer of raw materials, are already putting the brakes on. Goldman reckons that will reach 5.4m tonnes by 2030.įor some people, the case for another commodity supercycle has more holes in it than Swiss cheese. At present, annual “green” demand for copper is 1m tonnes, or just 3% of supply. Copper goes into the cabling for EV charging stations, and into solar panels and wind turbines. It takes four or five times as much copper to build an electric vehicle as a petrol-fuelled one.

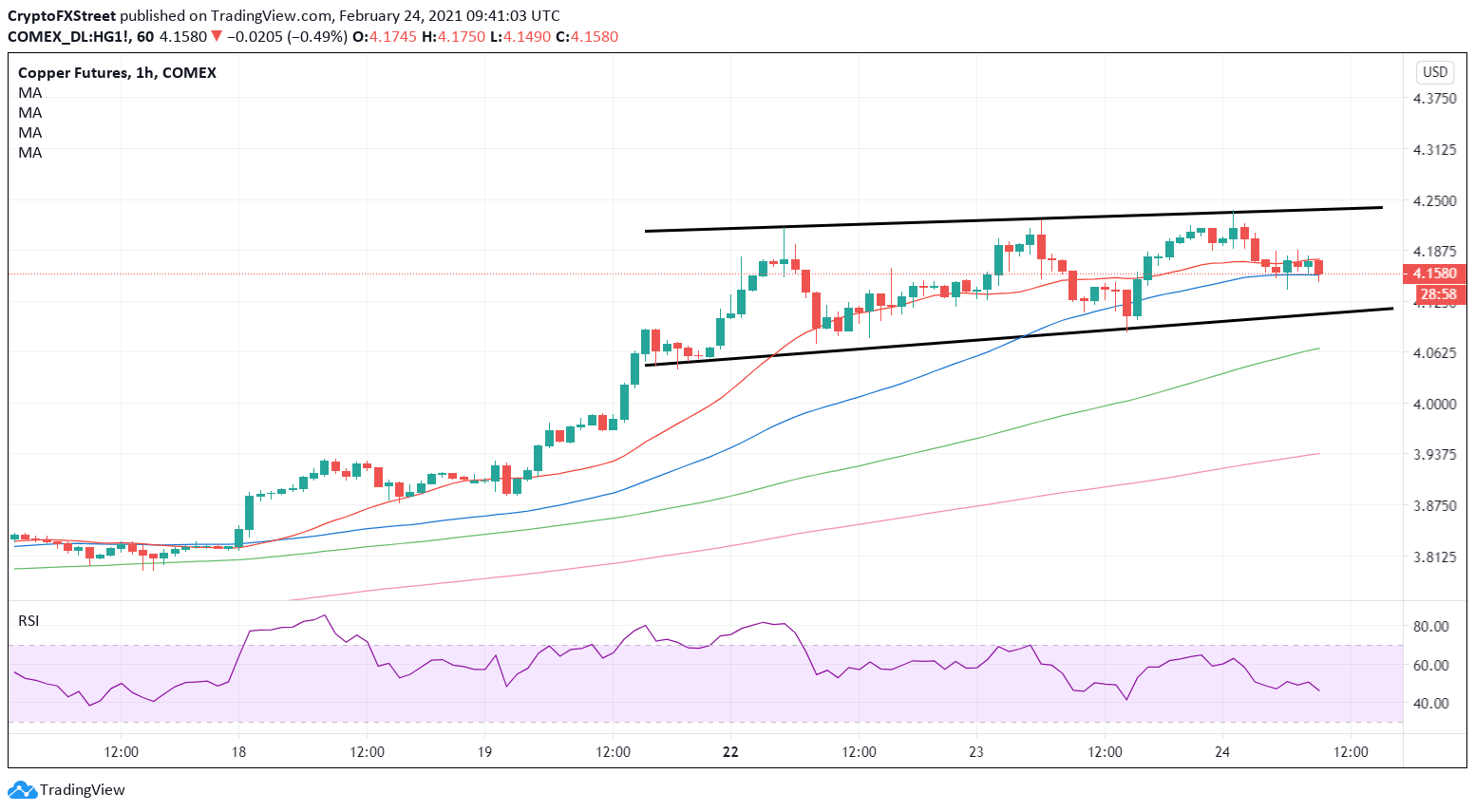

As a pliable, cost-effective conductor of heat and electricity, copper is a vital input to green tech. The spur to rapid demand growth will come, not from China, whose urbanisation lay behind the supercycle of the first decade of this century, but from the greening of richer countries. A recent note from Goldman Sachs, a bank, predicts that prices will rise to $15,000 per tonne by 2025, from $10,000 today, as the red metal undergoes a new supercycle, a longish period in which demand outstrips supply. Some analysts believe that the current copper shortage will prove to be a structural feature. A market in steep contango signifies a short-term glut. The opposite condition, in which futures prices are above spot, is “contango”. It is a telltale sign of physical shortages. So backwardation is a prompt for stocks to be run down to meet immediate demand. Current and historical Copper prices, stocks and monthly averages. In a backwardated market, the marginal benefit of adding to copper stocks is low. Copper Dec 2022 3.671 +0.035 0.96 Data is Delayed 30 Minutes Latest Trading Prices provided by NYMEX New York Mercantile Exchange, Inc. In theory stock levels should respond to the spread between cash and future prices. The market for copper and other commodities, including oil, is currently in “backwardation”, a state in which futures prices are below cash prices (see chart). Here Dr Copper may offer some uncomfortable lessons.Ĭommodity prices are subject to wild swings, reflecting periodic gluts and shortages. 'Our revised estimates are now 22 and 32 above 2021E and 2022E. For the year the analysts said that they see copper prices averaging the year around 4.62 a pound rising to 4.75 a pound by 2022. A bigger question-mark hangs over the supply response. In the report, the bank said that they see copper prices rising to 5.25 a pound in the fourth quarter of this year into the first quarter of 2022. Plans for fiscal stimulus in America and Europe lean heavily towards greening the economy, which in turn favours copper demand. Amid excitement about a new commodity “supercycle”, copper has one of the stronger bull cases.

0 kommentar(er)

0 kommentar(er)